Way back in January 2016, I wrote this post.

In it I added some more recent bear markets to the table that I had previously gotten from somewhere and updated it to try and crystal ball-gaze as to whether to things would be better or worse and this is basically what I said then:

2015/2016 – Oil, China, Commodities rout / 3539.95 (high in Apr ’15). Given today’s close of 2559.75, we have had a total of a -27.7% drop over a total of 280 days.If we’re lucky, we’ll just have another 10% more of declines to go; If not, we’re looking at another 30%.

This bear has obviously felt more painful than the last one, especially so because things didn’t look very expensive from a PE10 point of view so I’ve been very early in suggesting that it’s not a bad time to get invested.

Oh, and how long more will the pain last? History suggests anywhere from 0-360 days. Either way, hang on for the ride!

I was pretty prescient as the post was dated 20 Jan 2016 while the market bottomed the very next day on 21 Jan 2016.

Unfortunately, of course, I was expecting the dour mood in the market to last anywhere from 0-360 days which meant that I only slowly bought into the market and by the time 2017 came around, I wasn’t fully invested and I felt that the market had run up too far.

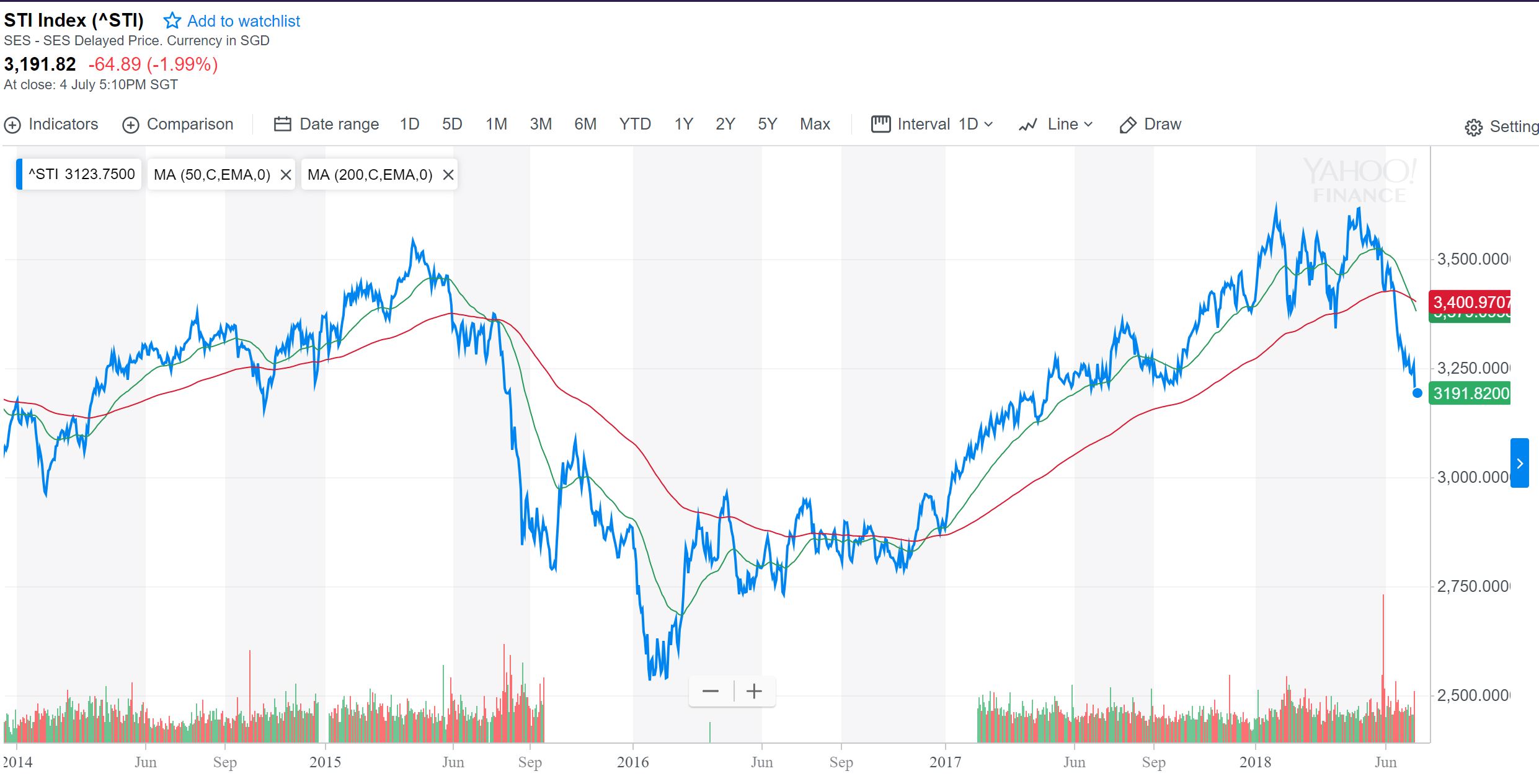

The markets eventually topped out at close to 3,600 in June 2018 and never got back to that level. You could also argue that the more recent high is the 3,400 or so level made in mid-2019 but whichever level you pick, I think it’s right to say that we are way off those highs right now.

What’s next?

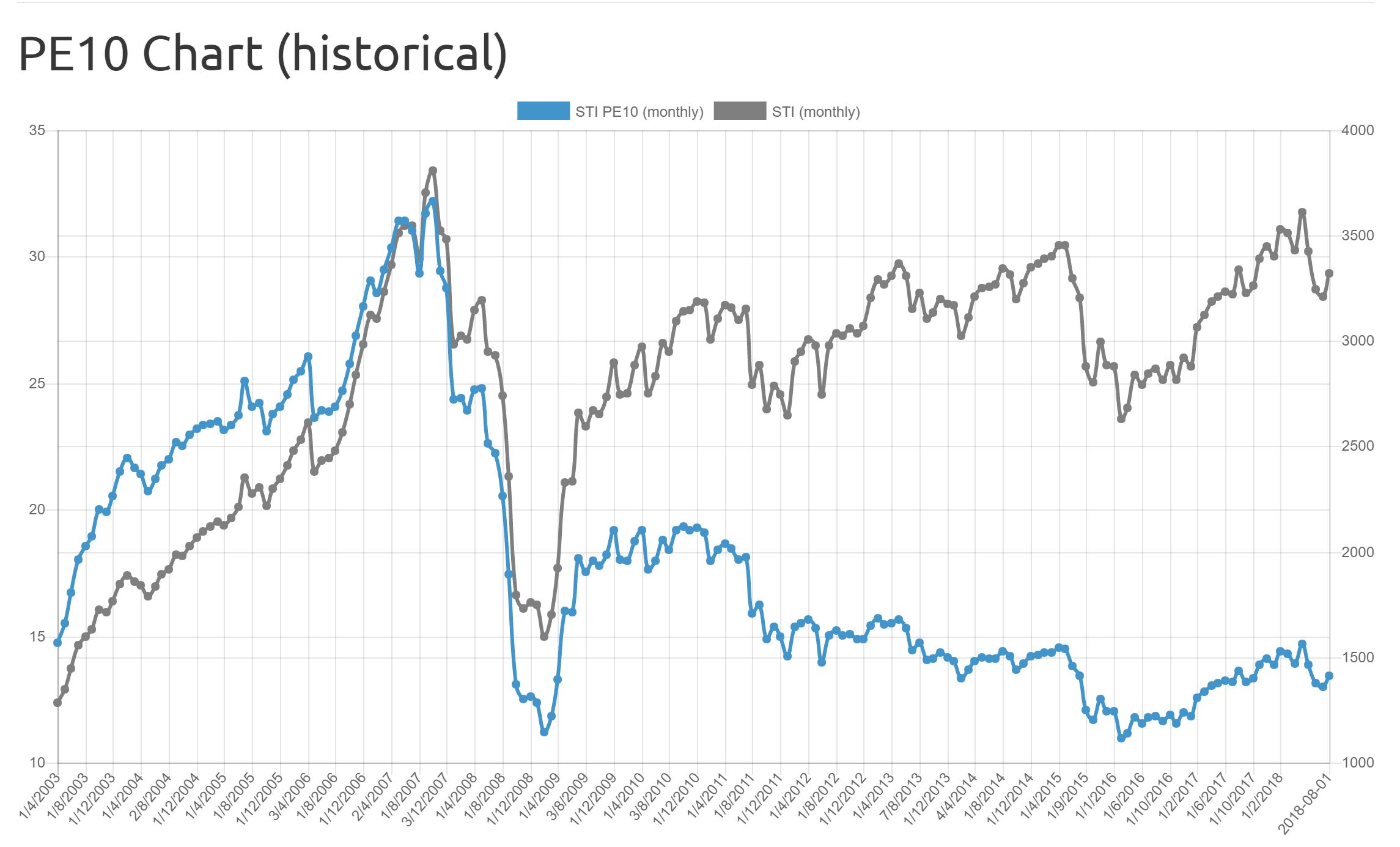

Those that have been following my blog for some time will know that I’ve been tracking the PE10 for the STI for a long time now and based on the PE10 measure, the STI in recent years has traded anywhere from 10.95x in Jan 2016 to 14.67x in May 2018.

Of course, the PE10 was lower than 10.95x towards the end of Jan 2016 but it’s close enough to give us a sense of how cheap things are and how cheap things could get.

I haven’t updated the PE10 since it isn’t the beginning of the month but the 10 year average earnings are currently about 260 which means that the current PE10 is just slightly over 10x earnings.

This is really the cheapest it has been for the data I have. Once again, the PE10 isn’t perfect and the data I have doesn’t track it perfectly but it gives us a good sense of the environment we’re in.

Could it get worse?

This is where some bear market history could be instructive.

| Start date | End date | Index start | Index end | % change | Period (days) | Event | Singapore Recession? |

| 03/04/1985 | 15/4/1986 | 690 | 456.35 | -34% | 407 | US Recession | Yes |

| 08/11/1987 | 12/07/1987 | 1288.13 | 595.77 | -54% | 118 | Black Monday | No |

| 16/7/1990 | 10/11/1990 | 1304.49 | 855.63 | -34% | 87 | US Recession | No |

| 17/2/1997 | 09/04/1998 | 2129.81 | 805.04 | -62% | 564 | Asian Financial Crisis | Yes |

| 01/03/2000 | 21/9/2001 | 2582.94 | 1241.29 | -52% | 627 | Dot-com | Yes |

| 19/3/2002 | 03/10/2003 | 1808.41 | 1213.82 | -33% | 356 | SARS | Yes |

| 10/11/2007 | 03/09/2009 | 3875.77 | 1456.95 | -62% | 663 | GFC | Yes |

| 11/11/2010 | 10/05/2011 | 3293.39 | 2528.71 | -23% | 180 | Euro-debt | No |

| 16/4/2015 | 21/1/2016 | 3531.61 | 2532.7 | -28% | 281 | O&G blowout | No |

So, if history is to be our guide, we need to ask ourselves which history looks similar to our situation? Is this more like 2016 or more like 2008?

If it’s 2015-16

If things are more like ’15-16, then expect the markets to drop at least another 10-15% from here and for the pain to last for another 5-6 months. I suppose the narrative in this case would be that no other bad news hits the markets and that the current narratives see the light at the end of the tunnel.

If it’s 2008-2009

First off, notice I didn’t say 2007. 2007 was the official top in the market, after which the market began a gradual slide amidst rumblings of trouble for financial institutions.

Then the panic hit in 2008 with the collapse of Lehman Brothers (September 2008) which followed the fall of Bear Stearns (March 2008). However, markets didn’t bottom until some 6 months later in March of 2009.

The difference between September 2008 and now is that markets had already fallen by some 50% from their levels in March 2008. Right now, markets have only fallen some 20+% which barely puts us in a bear market.

This scenario would probably play out if we start to see some sort of widespread credit event filter into the market as a result of the COVID-19 and OPEC+ situation.

Crystal-balling

Therefore, considering all scenarios. If I had to make a very, very rough guess, I would say that we should look for a bottom at around 1800-2200.

However, relative to even the GFC, valuations for the STI would be ridiculously cheap at those levels. Unfortunately, U.S markets aren’t cheap and that is driving a lot of market activity nowadays.

The thing that the market has going for it right now that is that markets have fallen so much in such a short period of time which almost makes it certain that we should see markets rebound hard in the coming weeks. In fact, the rebound might have already begun last Friday.

Regardless, watch the markets closely over the next 6-9 months. Chances like this don’t come around that often and don’t try to bottom fish because no matter how smart you are, you will probably never catch the market at the bottom.

tl;dr

The chance to get into markets at cheap valuations have come once again. It isn’t anywhere near as cheap as 2016 or 2009 yet but I’m sure we’ll get there.

However, things are probably only just getting started and will likely play out over the next 6-9 months.