I’ve been seeing these sorts of posts on my feed and most of these posts are so badly written because they don’t consider any individual investor’s circumstances and/or no finance theory behind the allocation so I thought I’d ask Google’s Gemini Pro (GGP) to take a stab at it.

The rest of the post is the response from GGP.

What do y’all think of GGP’s take on asset allocation for 2024?

**Asset Allocation:**

* Stocks: 70%

* Bonds: 15%

* International Stocks: 10%

* Singapore Real Estate: 5%

**Index Funds and ETFs:**

* **Singapore Stocks:**

* **STI ETF (SGX: STI):** This ETF tracks the Straits Times Index, which represents the 30 largest and most liquid companies listed on the Singapore Exchange (SGX).

* **Nikko AM Singapore Dividend Leaders ETF (SGX: NDLV):

** This ETF invests in Singapore companies with a history of paying dividends.

* **International Stocks:**

* **Vanguard Total International Stock Index Fund (VXUS):

** This fund offers exposure to stocks from developed and emerging markets outside Singapore and the U.S.

* **iShares Core MSCI EAFE ETF (IEFA):

** This ETF provides exposure to developed markets outside Singapore and the U.S.

* **Bonds:**

* **ABF Singapore Bond Index Fund (SGX: A35):

** This ETF tracks the FTSE Singapore Bond Index, which represents the Singapore dollar-denominated bond market.

* **LionGlobal SGD Enhanced Duration Bond ETF (SGX: LDS):

** This ETF invests in Singapore government and corporate bonds with longer maturities.

* **Singapore Real Estate:**

* **Ascendas REIT (SGX: A17U):

** This REIT invests in a portfolio of industrial properties in Singapore.

* **CapitaLand Integrated Commercial Trust (SGX: C38U):

** This REIT invests in a portfolio of shopping malls, offices, and serviced residences in Singapore.

**Investment Strategy:**

* **Regular Contributions:

** * Consider setting up a recurring investment plan to contribute a fixed amount to your investment accounts each month. This strategy, known as dollar-cost averaging, can help reduce the impact of market volatility and potentially increase your returns over time.

* **Rebalance Annually:**

* Once a year, review your portfolio’s asset allocation and rebalance it if necessary. This means selling some assets that have performed well and buying more of those that have underperformed. Rebalancing helps maintain your desired asset allocation and risk level.

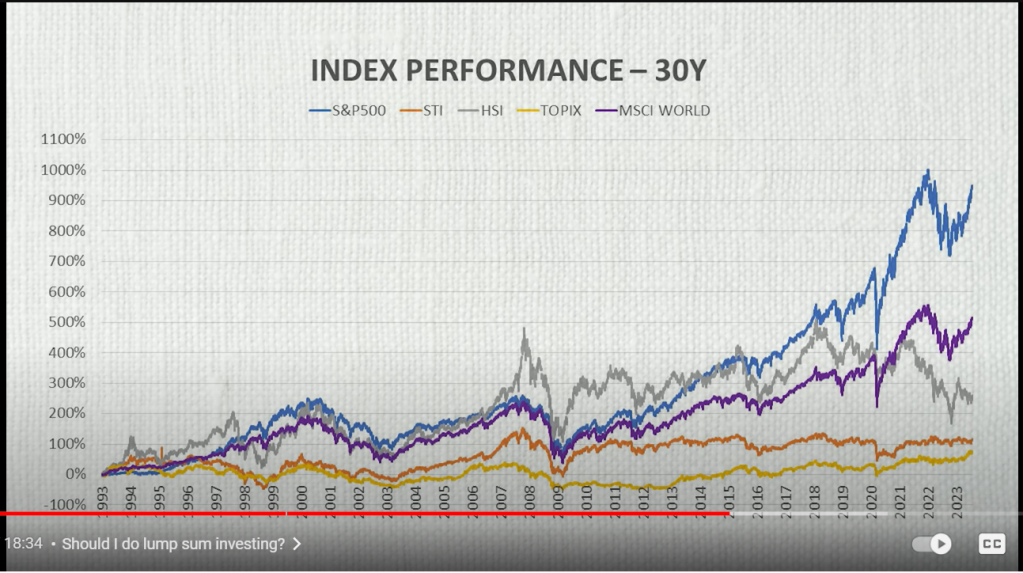

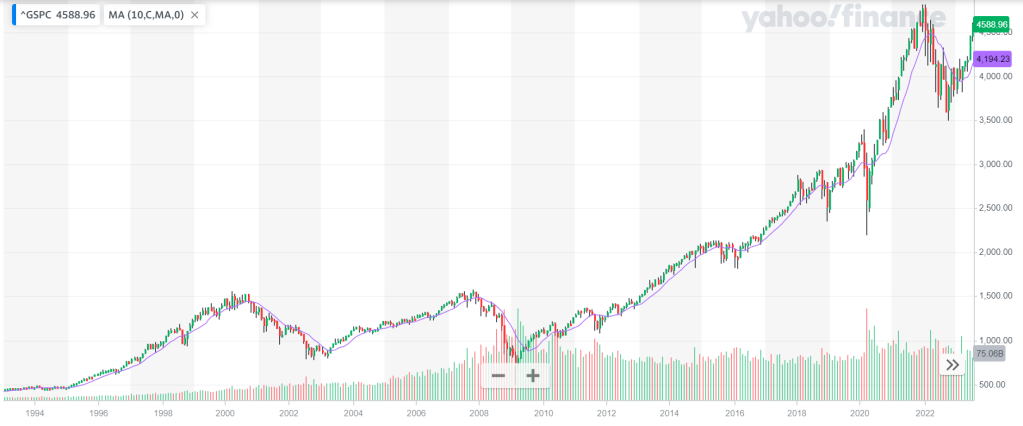

* **Stay Invested for the Long Term:**

* Remember that investing is a long-term game. Avoid making impulsive decisions based on short-term market fluctuations. Stay invested through market downturns, as history has shown that stocks tend to recover and reach new highs over the long term.

**Additional Considerations:**

* **Tax-Advantaged Accounts:**

* Consider investing in tax-advantaged accounts, such as the Supplementary Retirement Scheme (SRS) and the Central Provident Fund (CPF), if available. These accounts offer tax benefits that can help your investments grow faster.

* **Emergency Fund:**

* Before investing, make sure you have an emergency fund with 3-6 months of living expenses saved up. This fund can help you cover unexpected expenses without having to sell your investments. *

**Investment Goals:**

* Keep your investment goals in mind when making investment decisions. If you have a long-term goal, such as retirement, you may be able to tolerate more risk in your portfolio.

* **Risk Tolerance:**

* Assess your risk tolerance and invest accordingly. If you are uncomfortable with the potential for large swings in your portfolio’s value, you may want to allocate a larger portion of your portfolio to bonds and other less volatile investments.

**Disclaimer:** Investing involves risk. Past performance is not a guarantee of future results. The information provided is for general informational purposes only and should not be construed as investment advice. It is essential to consult with a qualified financial advisor before making any investment decisions.

**Note:** The investments mentioned above are just examples, and the specific funds or ETFs you choose may vary depending on your individual circumstances and investment goals. It is always a good idea to consult with a qualified financial advisor in Singapore who can provide personalized advice based on your unique situation.